While production of horticulture crops is growing, the ‘demand’ side is also witnessing a marked growth. As incomes rise and consciousness about ‘healthy foods’ increases, there is a significant change in the consumption basket of consumers. Households are spending significantly higher amounts of their expenditure on food to the F&V category. Horticulture has also done very well on the export front as well, and over the last decade the growth has been to the extent of 150%, with exports in the last fiscal touching Rs 13,000 crores. (This does not include exports of tea, coffee and rubber, which are covered as plantation crops).

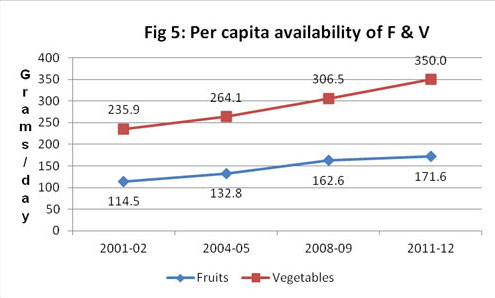

However, it is important to note that the availability of fruits and vegetables has kept pace with the growing demand in both domestic and global markets. Thus, in the case of fruits, the per capita availability increased from 114 grams / day in 2001-02 to 169 grams / day in 2011-12. Similarly, the per capita availability of vegetables increased from 236 grams / day to 338 gram / day during this period. Trend in per capita available of Fruits and Vegetables is given below.

|

Towards Inclusive and Sustainable Growth in Horticulture:

The major challenge for horticulture is to sustain this growth in a manner which ensures higher incomes for the primary producer by ensuring better institutional support mechanisms, infrastructure and technology support for the entire value chain – from pre –planting to Post Harvest management. While the ICAR system with its research institutions, State Agricultural universities and National Resource Centres have addressed issues relating to soil health, planting material, new and adaptive varieties, the major challenge for the DAC is to ensure higher returns to the farmer by ensuring that what is produced is not lost in transit on account of perishability, or poor handling at any stage between the farmer’s field to the consumer’s table. The link between perishability and farmer’s income has been brought out succinctly by the Planning Commission Committee on the subject, headed by Dr Saumitra Chaudhri. This committee made four major recommendations, which include, inter alia: strengthening institutional linkages between producers and consumers, recognition of the role of market intermediaries and supporting their efforts in backward integration, policy changes in APMC Acts to break the monopoly of the existing players and fiscal incentives to encourage investments in the sector. These suggestions are now in various stages of implementation.

Institutional Linkages between producers and suppliers:

Three major initiatives of the DAC come under this broad head, and have the potential to impact farmers’ incomes in a positive manner. These include the Vegetable Initiative for Urban Clusters (VIUC), support to FIGs and FPOs for better integration with markets and input suppliers and the PPP IAD (Public Private Partnership for Intensive Agricultural Development). The salient features of these are discussed below.

VIUC: Under the VIUC farmers living in peri-urban areas are encouraged to take up vegetable production in clusters to ensure primary level aggregation and better co-ordination with wholesalers and retailers. The idea is to support farmers with all essential inputs – from credit to seeds to soil nutrients – and assist them in primary level aggregation, grading, sorting, packaging and transport to the wholesale, and wherever possible retail points as well. It encourages farmers to have direct linkages with the large aggregators or retailers so that the farmers get a better value for their produce.

FPOs: VIUC has also encouraged the formation of Farmer Interest Groups and Farmer Producer Organizations by encouraging the formation of cluster level Farmer Interest Groups (FIGs) which were organized into FPOs. This strategy was based on the clear understanding that given the fragmented land holding pattern among primary producers, it was necessary to adopt the cluster based approach to achieve the economies of scale and scope. The task was assigned to the Small farmers Agribusiness Consortium, an agency of the DAC.

PPP IAD: While the formation and support to FPOs and FPCs is an attempt at forward integration with the markets, the PPP IAD is an effort to facilitate backward integration of agribusiness organizations with producers. Under this programme, for which support is available under the RKVY, corporates are encouraged to undertake extension services, and or market linkages to clusters of five thousand farmers. The subsidies and incentives which had to be given by the state can be routed through the corporate partner, who must put in an equivalent amount, besides providing marketing support.

APMC Reforms:

APMC reforms are critical to the development of a value chain in horticulture produce, especially perishables. While production has increased manifold- both in terms of volume and value , the number of intermediaries has remained ‘constant’ on account of the provisions of the APMC Acts ,most of which prescribe ownership of a premises in the market yard as a pre –condition to apply for a license. Many state governments have agreed, in-principle, to amend the Act and also introduce electronic auctions, besides allowing the establishment of terminal markets and electronic auction platforms. As has been reported in these columns, once Delhi amends its Act, there will be a sea-change in the agricultural marketing scenario.

Fiscal Incentives:

The Report also recommended that government continue the fiscal incentives for the sector .These include enhanced support for cold chain projects by upward revision of credit linked back ended subsidy from 25% to 40% of the capital cost of a project in general areas and from 33.33% to 55% in case of Hilly & scheduled areas, in respect of units which adopt new technologies. Secondly, a provision of Rs 5000/crores for investments in warehousing and cold chain infrastructure was kept under the Rural Infrastructure Development Fund (established by NABARD). The third step was the reduction of Excise Duty on Import of Cold Storage Equipments including refrigeration panels for cold chain infrastructure and conveyor belts .Last but not the least, the government has allowed External Commercial Borrowing (ECB) for investments in cold chain infrastructure, including on –farm storage, refrigerated transport and associated logistics.